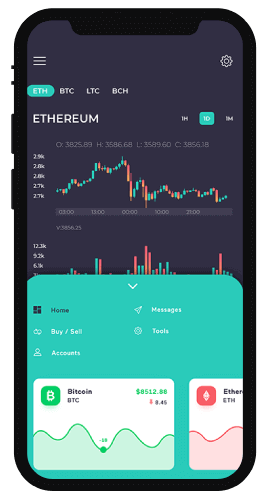

Cryptocurrency Exchange Platforms

A cryptocurrency exchange platform is a digital system that enables users to buy, sell, and trade cryptocurrencies. These platforms act as intermediaries or peer-to-peer networks that facilitate crypto asset transactions using blockchain technology. Understanding how cryptocurrency exchange platforms work, their types, and their core components is essential for businesses and users entering the digital asset ecosystem.

What Is a Cryptocurrency Exchange Platform?

A cryptocurrency exchange platform is an online infrastructure that allows users to trade digital assets such as Bitcoin, Ethereum, and other cryptocurrencies. These platforms manage order execution, liquidity, transaction settlement, and user account interactions while maintaining security and compliance standards.

Exchange platforms may operate as custodial systems, where the platform manages user funds, or non-custodial systems, where users retain full control of their assets through smart contracts and decentralized mechanisms.

CRYPTOCURRENCY EXCHANGE FEATURES

- Analytical Dashboards

- Currency And Language Setting

- Affiliate Reporting Add

- Buy/Sell Ads

- Organize Risk Management

- Manage Liquidity API

- Trade Pairs Management

- FeedBack System

- Smart Filters

- Instant/Manual Approval

- Integrate Multicurrency

- Commission Management

- Price Ticker

- High Secure Wallet

- Dispute Management

- Currency Activation

- Dashboard Widget

- Private Messaging

- API Based CurrentRate Display

- Transaction History

- Atomic Swap

- Referral Program

- Payment Method

- Complaint Status

- Spot Trading

- Market Price

- Check Ticket Status

- Check Hot Wallet Balance

- OTC Trading

- Limit Price

- Track Live Order Book

- Transaction History

- Mobile Trading

- Review All Coin Info

- Recent Crypto Orders

- Biometric Authentication

- Two-Factor Authenticationb (2FA)

- Firebase, Firewall Implementation

- Anti-Phishing Software

- DB Encryption

- Regular Security Audits

- DDOs Withstand Ability

- End-To-End Encrypted Transactions

- Multi-Sig Wallets

- CSRF Protection

- Face &Fingerprint 1D

- Jail Login Method

- SSL Integration

- SBrowser Detection Security

- Decentralised Data Handling

- Escrovw Management

- Encrypted Crypto Wallets

- KYC And AML Verification

- IP Login Restriction

- Margin Trading

- DeFi Staking

- Selfie & Video KYC

- IEO Launchpad

- OTC Trading

- 3rd Wallet

- Volume Bot

- Peer-To-Peer Exchange

- Dynamic Crypto Pairing

- Trade Bot

- SAutomated KYC API

- Coin Market Cap List

How Cryptocurrency Exchange Platforms Work

User Access & Verification

Users create accounts or connect wallets depending on the exchange model

Asset Management

Funds are held in custodial wallets or managed through smart contracts

Order Placement

Users place buy or sell orders on the trading interface

Trade Execution

Transactions are executed and recorded on the platform or blockchain

Deployment

After our professionals have completed their testing, it is then placed in the client's network and ready to function and trade.

Settlement

Assets are credited to user accounts or wallets

Types of Cryptocurrency Exchange Platforms

A typical cryptocurrency exchange platform follows a structured workflow to execute trades securely and efficiently:

Centralized Exchange Platforms (CEX)

Centralized exchanges operate under a single authority that manages user funds and trade execution. These platforms offer high liquidity, fast transactions, and advanced trading tools but require trust in the platform operator.

Decentralized Exchange Platforms (DEX)

Decentralized exchanges enable direct peer-to-peer trading using smart contracts without relying on a central authority. Users retain control of their assets, increasing transparency and reducing custodial risk.

Hybrid Exchange Platforms

Hybrid exchanges combine the performance and liquidity of centralized platforms with the security and privacy benefits of decentralized systems.

Key Components of a Cryptocurrency Exchange Platform

Trading interface and order book

Wallet infrastructure for asset storage

Matching and execution logic

Liquidity management systems

User account and access management

Monitoring and reporting tools

Security Considerations in Cryptocurrency Exchange Platforms

Security is a foundational requirement for any exchange platform. Common security considerations include:

- Secure authentication and access controls

- Encrypted data transmission

- Custodial and non-custodial asset protection models

- Protection against unauthorized access and transaction manipulation

- Continuous monitoring and system audits

The security architecture varies depending on whether the platform is centralized, decentralized, or hybrid.

Why Choose Blockchain App Maker for Exchange Development

As a top cryptocurrency exchange development company, we are experts at creating platforms that can function dependably in high-risk, high-volume trading environments. Our development approach places a strong emphasis on scalability, fault tolerance, and operational efficiency to guarantee that your cryptocurrency exchange operates flawlessly during periods of high market activity, price volatility, and quick user growth.

Advanced order-matching engines, multi-chain wallet integration, real-time market data feeds, liquidity management systems, and AI-driven risk monitoring tools are just a few of the cryptocurrency exchange development services we offer. Every cryptocurrency exchange platform is designed to manage quick trade execution, safe asset storage, and continuous availability in both mobile and web environments. Regardless of whether you need a hybrid trading model, decentralized exchange, or centralized exchange, we provide solutions that support your company’s goals.

Our team facilitates quick deployment without sacrificing flexibility or control, from fully customized exchange platforms to white-label cryptocurrency exchange software. Each solution helps businesses shorten time to market while preserving the flexibility to scale, customize features, and adjust to changing market and regulatory demands. They are all configurable, integration-ready, and optimized for global expansion.

- Solutions with a 100% white label

- 50+ Blockchain & Cryptocurrency Experts With Years Of Experience

- Meets all security requirements, including cyber security, penetration testing, and bug bounty.

- 7+ Years of Cryptocurrency Exchange Development Experience

- We Have Expertise in 15+ Blockchain Networks

- Quickness in delivery. Communication, guidance, and cost-effective prices are all important factors.

Web & Mobile Cryptocurrency Exchange Development

The Benefits of Using a Cryptocurrency Exchange App

Fingerprint / Face ID

Impulsive Interface

Mobile Wallet

Multi-lingual Support

Advanced Storag System

Lock Screen Notification

Web Technology Stack

Mobile Technology Stack

Launch a Compliant, High-Performance Cryptocurrency Exchange

Build a custom cryptocurrency exchange platform designed for security, scalability, and regulatory readiness. Our cryptocurrency exchange development services help businesses launch enterprise-grade trading platforms with robust architecture, advanced security controls, and long-term performance in mind.

From exchange planning and system design to development, testing, and deployment, we support the entire lifecycle of your platform. Whether you’re launching a centralized, decentralized, hybrid, or P2P exchange, our team ensures your exchange is compliant, resilient, and built to scale with market demand.

Talk to our experts today to confidently launch a high-performance cryptocurrency exchange tailored to your business goals.

FAQ

Cryptocurrency exchange development involves building a safe online space where people can trade digital currencies. This involves setting up the exchange’s structure, connecting digital wallets, matching buy and sell orders, handling currency flow, putting security measures in place, and following the rules.

The exchange type and feature complexity determine the development timeline. While a completely customized cryptocurrency exchange platform might take several months to establish, a white-label cryptocurrency exchange could be done in a few weeks.

Yes. Trading fees, listing fees, liquidity services, staking, and loans are how cryptocurrency exchanges make money. Exchanges can develop into extremely lucrative digital assets with the correct feature set and scalability.

To safeguard user cash and data, a secure cryptocurrency exchange should have multi-factor authentication, DDoS protection, encryption, cold and hot wallet management, anti-fraud measures, and ongoing monitoring.

Yes. To operate lawfully, gain user trust, and enter regulated markets without running the risk of legal trouble, compliance with KYC, AML, and data protection rules is crucial.

The cost of development is determined by the exchange features you want to include in your exchange platform. Now is the time to get a free quote for your bitcoin exchange.

Expert guidance and development help are required to launch a bitcoin exchange platform. Another efficient method is to buy a white label bitcoin exchange script that can be customised to meet the needs of the users. White label bitcoin exchange script with comprehensive exchange functionalities is available from Blockchain App Maker.

Entrepreneurs may download the bitcoin exchange from Blockchain App Maker to start a Cryptocurrency Exchange. Within 48 hours, you can launch your cryptocurrency exchange platform.

We used cutting-edge technologies like as PHP, Mean & MERN stack, JAVA, and others to create the robust Bitcoin and Cryptocurrency Exchange. We can also create bitcoin exchange from scratch using the technology stack of your choice for your own cryptocurrency exchange development.

Choosing the Right Cryptocurrency Exchange Platform Model

Selecting the appropriate exchange platform model depends on multiple factors such as business objectives, regulatory requirements, target users, and operational complexity. Centralized platforms are often chosen for high-volume trading environments, while decentralized and P2P models appeal to users prioritizing transparency and control.

Businesses exploring platform creation can evaluate different exchange models before deciding on the most suitable approach.

Related Exchange Services

Organizations looking to build or deploy an exchange platform can explore dedicated service options:

- For fully customized platforms, see Cryptocurrency Exchange Development Services

- For faster deployment using ready-made systems, explore White Label Cryptocurrency Exchange Solutions

We Spotlighted In

History is tedious! Numbers,

on the other hand, aren't!

Projects In Progress

50+

Blockchain Experience

4+ Years

Blockchain Experts

80%

Projects Completed

150

Team

300+

Talk To Our Experts